#billions vs $700

Explore tagged Tumblr posts

Text

#ukraine#rebuild maui#biden administration#joe biden#billions vs $700#maui wildfires#maui hawaii#money laundering

87 notes

·

View notes

Text

DCMK Blu-rays

A list of Detective Conan and Magic Kaito content with physical HD releases.

This won't be comprehensive by any means; I'm going to be focusing on Japanese, German, and United States releases because these are the ones that I own and am most familiar with. I believe that many of the films are also available on Blu-ray in several countries, dubbed in several languages, but I don't have much concrete knowledge about that at this moment. Please feel free to add any information!

That said, the main thing to know about Detective Conan Blu-rays is that... they kind of don't really exist. The television series is (mainly, more on this later) released on DVD only in Japan, usually with the equivalent of four episodes per disc, sold at 4,620 yen each. They're grouped in "Parts," with up to 10 Volumes per Part, and the next release, on June 23rd, will be Part 31, Volume 3, containing episodes 1007, 1008, 1010, and 1013.

A handful of episodes are released on Blu-ray via collections in Japan; there are the Treasured Selections and Akai Family TV Selections. But with a series running over 1,000 episodes, it really is just a handful of episodes available in these collections.

Treasured Selections

With the Treasured Selections, you can get 67 episodes on Blu-ray:

1: "The Roller Coaster Murder Case"

2: "The Kidnapping of the Company President's Daughter"

54: "The Game Company Murder Case"

128: "The Black Organization: One Billion Yen Robbery Case"

129: "The Mysterious New Student"

176-178: "Re-Encounter with the Black Organization"

226-227: "Battle Game Trap"

230-231: "Mysterious Passenger"

258-259: "The Man From Chicago"

271-272: "Hide, Hurry Up, and Abbreviate It"

277-278: "English Teacher vs. Great Western Detective"

286-288: "Shinichi in New York"

307-308: "The Remains of Voiceless Testimony"

309-311: "Contact with the Black Organization"

338-339: "Four Porsches"

340-341: "The Hidden Secret in the Toilet"

343-344: "Convenience Store Trap"

345: "The Confrontation with the Black Organization: The Coincidence of the Two Enemies on a Night with a Full Moon"

346-347: "Look for the Mark on the Buttocks"

361-362: "Teitan High School Ghost Story"

425: "Black Impact! The Moment the Black Organization Reaches Out."

427-428: "Super Secret School Zone"

429-430: "The Point of No Return"

462-465: "The Shadow of the Black Organization"

484-485: "The Whereabouts of the Black Picture"

491-504: "Red and Black Crash"

507-508: "Blind Spot of the Karaoke Shop"

509-511: "Conan VS Double Code Mystery"

However, anything before 286 is not in HD; these are all traditionally animated episodes that were not especially remastered for these releases:

Episodes 286 and beyond (from Treasured Selection 6 to 18) are digitally animated, and these Blu-rays are more properly HD:

Akai Family TV Selections

With the Akai Family TV Selections, you can get 33 episodes on Blu-ray:

563-564: "The Detective Squad vs. The Band of Robbers"

578-581: "A Red Omen That Summons Danger"

675-676: "Not Even a Millimeter of Forgiveness"

699-700: "Shadow Closes in on Ai's Secret"

701-704: "Pitch Black Mystery Express Train"

724-725: "Thief Kid and the Blushed Mermaid"

779-783: "The Scarlet Return"

785-786: "Taiko Meijin's Match of Love"

836-837: "The Unfriendly Girls Band"

861-862: "Just Like a 17 Year Old Crime Scene"

863-864: "The Spirit Detective's Murder"

866-867: "The Traitor's Stage"

881-882: "The Magician of the Waves"

Other Japanese Blu-rays

Beyond these, the TV-original specials Episodes 804-805 ("Conan and Ebizo's Kabuki Juhachiban Mystery") and Episodes 965-968 ("Kaiju Gomera VS Kamen Yaiba"), plus the canon Episodes 927-928 ("The Scarlet School Trip"), are also available on Blu-ray.

Finally, special edition Blu-rays for Movies 17-25 include a second disc containing the movie's tie-in anime episode... but that second disc is likely a DVD, speaking as someone who doesn't own any of these but does own the Japanese special edition Blu-rays for Movies 14 through 16, where the second discs are, indeed, DVDs.

German Blu-rays

Outside of Japan, Germany is currently releasing boxed sets of the Detective Conan series starting from Episode 1. At this time, these are the only physical releases of the remastered footage (which make a big difference), and they include Japanese and German audio (but any German-dubbed songs are omitted). Three boxes are available now, covering Episodes 1 to 96 (or 102 with the international numbering); a fourth box is set to be released on May 19th, covering up until Episode 122 (or 129 with the international numbering).

Do note that these releases edit the name boxes in a way that can't be turned off, however.

Films, Specials, and Magic Kaito

In Japan, there are Blu-ray releases for:

Films 1-25

Both Lupin crossovers

The Disappearance of Conan Edogawa: The Two Worst Days in History

Episode One: The Great Detective Turned Small

Magic Kaito and Magic Kaito 1412

In Germany, all of the same content is available on Blu-ray. There's also a Blu-ray release for The Scarlet Alibi, and I believe that they're the only ones with a physical HD release of Gosho Aoyama's Collection of Short Stories as well.

In the United States, there are Blu-ray releases for:

Films 19-23

Both Lupin crossovers

Episode One: The Great Detective Turned Small

As far as I'm aware, there are no HD releases anywhere of the OVAs. They're available on DVD in Japan, either separately or via four "Secret File" compilations (though these only cover OVAs 1-9).

There also aren't any HD releases of the Magic/Bonus files, but DVDs are included with the Japanese special edition versions of Movies 12-16. They're also available for individual purchase in Japan as well.

TV Specials 1, 2, and 4 (with 3 being the Lupin special, 5 being The Disappearance of Conan Edogawa, and 6 being Episode One) seem to be DVD only, too. Actually, I'm not sure if TV Special 1,"Time Travel of the Silver Sky," is available on disc at all? But TV Special 2, "Black History," is said to be included with the Japanese special edition DVD of the second live-action drama special, and TV Special 4, "Fugitive: Kogoro Mori," is included on the Part 24, Volume 7 DVD.

TV Special 7, "Love Story at Police Headquarters ~Wedding Eve~," might be included on Blu-ray in Japan with the special edition of Movie 25, but I can't confirm if that disc is a Blu-ray or DVD right now (and the same goes for The Scarlet Alibi, included with the special edition of Movie 24 in Japan).

The eight VHS-only Shogakukan Illustrated Encyclopedia Series tapes are obviously not available in HD, either.

Tl;dr?

So, in short, combining releases and eliminating the not-remastered Treasured Selections, you can find 186 episodes on Blu-ray right now (with more on the way with the fourth Detektiv Conan box). You can also get all of the films and Magic Kaito series, plus a few specials, in HD.

And I think that's all I've got! Feel free to add more information if you know any! I am desperate to physically own more HD DCMK content.

EDIT: I've done some more digging, and from what I can tell, starting with Movie 24, the Japanese special edition Blu-rays for the films changed the bonus second disc from a DVD to a Blu-ray instead. This means that Episode 1,002, "The Beika City Shopping Center Garbage Bin Mystery," included with the special edition of Movie 24, as well as Episode 1,039, "The Flying Jack-o'-lantern," included with the special edition of Movie 25, are available on Blu-ray, too. So, a more accurate number of episodes that have been released on Blu-ray (in HD) at this time is actually 188. Further, this confirms that The Scarlet Alibi and TV Special 7 are also available on Blu-ray in Japan.

Additionally, though I have provided a couple of links throughout this post, the Detective Conan World wiki deserves a bigger shout out than I initially gave; their "Collectibles" page, and particularly their "Japanese Blu-ray" article, were a huge help in compiling the information laid out here. Many, many thanks to the contributors.

And while I'm here, for those interested in English-language releases specifically, Magic's Detective Agency is a fantastically detailed resource for every DVD released by FUNimation (Volumes, Season Sets, and Films). They're not HD releases, true, but at the time, they're the only physical releases of any episodes and the first six films in English.

Finally, I also discovered that a fifth Detektiv Conan box is set to be released on July 21st! This should mean that remastered episodes up until 145 (or 155 with the international numbering) will be available on Blu-ray, and it bodes well for these releases to continue. Hopefully, there will be physical releases of the remastered footage in other countries, too!

#detective conan#case closed#dcmk#long post#ramblings#detco dvd saga#well blu-rays really but that's my tag ^^;#shrug emoji i just really want more physical hd releases...#it was a journey to figure out what's available so i hope this is helpful for any other collectors!

85 notes

·

View notes

Text

Another case of lofty goals and lack of tangible support

At COP15 last year, countries agreed to a biodiversity deal that includes protecting and restoring 30% of the world's land and seas by 2030. As part of the deal, it was agreed that wealthy nations will contribute US$30bil/year to ensure that low to middle income countries (LMICs) are also able to achieve the target.

During COP15, LMICs that are biodiversity-rich called for a new independent fund, because the current funding manager, called Global Environment Facility (GEF), is too slow to distribute funds and inaccessible. But high income countries disagreed and decided that the new fund should still be managed by GEF.

There are other concerns too, e.g. upfront commitment of money (LMICs) vs setting up the trust first then discussing budget later. Also, the current proposed fund (which high income countries still arent willing to commit upfront to) is $200 million, whereas research estimated show that to achieve the goal, $700 billion is required.

Countries are expected to meet and review this proposal in these few days, but there seems to be still no tangible commitment on the horizon

#aslzoology#asl zoology#zoology articles#sustainability#nature#studyblr#climate change#biodviersity#naturecore#animals#funding#money

1 note

·

View note

Text

None of yall have been desperate enough to try the lottery and know that you either accept a pay out paid in annual installments for 30 years (The full amount of 2 billion which would be taxed but not down to 400 million probably) vs immediately taking what is available on hand (probably like 700 million) and that 700 million taxed lead to 400 million. Not that it’s still not bullshit but this is readily available information.

59K notes

·

View notes

Text

Avengers: Endgame vs. Deadpool & Wolverine – A Box Office Showdown

Marvel fans, brace yourselves! A deep dive into the astonishing box office numbers of Deadpool & Wolverine versus Avengers: Endgame. Is Marvel’s golden era fading, or is the franchise still setting new records? Let’s break it down!

Introduction

Avengers Endgame vs. Deadpool & Wolverine – A Box Office Showdown (3) The Marvel Cinematic Universe (MCU) has long been a dominant force in Hollywood, consistently delivering blockbuster hits that rake in billions at the global box office. While not every installment has shattered records, the franchise has produced some of the most lucrative films in history. Avengers: Endgame stands at the pinnacle of this success, setting an almost unmatchable benchmark. But how does the recent Deadpool & Wolverine movie compare? Let’s dive into the numbers and find out what this means for the MCU’s future.

Deadpool & Wolverine: A Billion-Dollar Powerhouse

Why Was Deadpool & Wolverine So Successful?

The success of Deadpool & Wolverine didn’t just happen overnight. Several key factors contributed to its massive box office pull: - Deadpool’s Proven Formula: The first two Deadpool films each earned around $700 million, proving there’s an appetite for R-rated superhero action. - Wolverine’s Return: Hugh Jackman’s Wolverine was a major draw, despite playing a different variant from the Logan timeline. - MCU Integration: For the first time, Deadpool officially joins the MCU multiverse, attracting hardcore Marvel fans. - Cameo Frenzy: A slew of major Marvel cameos and actor returns fueled fan speculation and repeat viewings.

The Box Office Numbers

According to The Numbers and Box Office Mojo, Deadpool & Wolverine grossed approximately $1.3 billion worldwide, making it one of the most successful Marvel films in recent years. This places it among the top MCU earners, surpassed only by the Avengers movies and Spider-Man: No Way Home.

Comparing the Box Office: Deadpool & Wolverine vs. Avengers: Endgame

Avengers Endgame vs. Deadpool & Wolverine – A Box Office Showdown (4) Avengers: Endgame – The Undisputed Champion While Deadpool & Wolverine made an impressive $1.3 billion, it pales in comparison to Avengers: Endgame’s mind-blowing $2.7 billion worldwide haul. This nearly twofold gap highlights just how unprecedented Endgame’s success truly was. Why Did Endgame Make So Much More? - Decade-Long Payoff: It was the culmination of 11 years and 21 films, a cinematic event fans couldn’t miss. - Infinity War’s Cliffhanger: The unresolved fate of key characters drove immense anticipation. - Must-See Status: Endgame wasn’t just a movie; it was a cultural phenomenon, demanding repeat viewings.

The Perspective Shift

It’s easy to celebrate Deadpool & Wolverine for its billion-dollar success—until you compare it to Endgame. The fact that even doubling Deadpool & Wolverine’s box office wouldn’t surpass Endgame shows just how surreal Endgame’s numbers really were.

Can the MCU Ever Top Avengers: Endgame?

The Changing Landscape

The MCU’s recent trajectory has been a mixed bag: - Highs: Spider-Man: No Way Home crossed $1.9 billion, proving Marvel can still deliver major wins. - Lows: Other Phase 4 and 5 films, like Eternals and Ant-Man: Quantumania, failed to capture the same audience enthusiasm.

Future Avengers Movies

Marvel has already announced Avengers: The Kang Dynasty and Avengers: Secret Wars, but will they live up to the hype? While every Avengers film has surpassed $1 billion, reaching Endgame’s heights again seems increasingly unlikely.

Avengers Endgame vs. Deadpool & Wolverine – A Box Office Showdown (1) 1. Is Deadpool & Wolverine the highest-grossing R-rated movie? Not yet! Joker (2019) still holds that title with over $1 billion, though Deadpool & Wolverine is close. 2. Could Avengers: Endgame be topped someday? It’s possible, but highly unlikely. It had the perfect storm of nostalgia, storytelling payoff, and cultural relevance. 3. Does Deadpool & Wolverine’s success mean the MCU is back? Not necessarily. While it’s a great sign, the MCU needs consistency across multiple films to regain its former dominance.

Conclusion

Marvel’s Deadpool & Wolverine has proven that the MCU can still produce box office juggernauts, but when compared to Avengers: Endgame, it’s clear just how difficult it will be to ever surpass that record-breaking success. While the superhero genre isn’t dead, the MCU’s next moves will determine whether it can ever reach those heights again. Read the full article

0 notes

Text

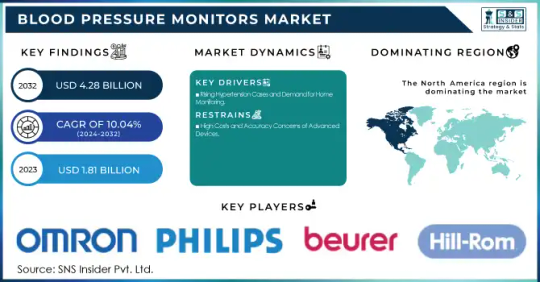

Blood Pressure Monitors Market: Industry Trends and Forecast 2024-2032

The Blood Pressure Monitors Market size was valued at USD 1.81 billion in 2023 and is estimated to grow to USD 4.28 billion by 2032, with a CAGR of 10.04% over the forecast period of 2024-2032. Increasing awareness of hypertension and preventive healthcare, along with advancements in technology, are driving the demand for blood pressure monitoring devices worldwide.

Regional Analysis

The market shows significant regional variations, influenced by healthcare infrastructure, economic development, and the prevalence of hypertension. North America leads due to advanced healthcare systems and high awareness of preventive healthcare. Europe follows closely, with a strong focus on home healthcare solutions. The Asia-Pacific region is expected to witness rapid growth, driven by increasing healthcare investments and a rising incidence of hypertension.

Get Free Sample Report @ https://www.snsinsider.com/sample-request/3448

Market Segmentation

By Product:

Devices:

Sphygmomanometers

Digital BP Monitors

Ambulatory BP Monitors

Accessories:

Blood Pressure Cuffs

Transducers

Others

By End-User:

Hospitals & Clinics

Home Healthcare

Others

Key Players and Their Blood Pressure Monitor Products

Omron Healthcare – Evolv, Platinum, Gold, Silver, 7 Series, 10 Series, 3 Series

Hill-Rom Holdings, Inc. (Welch Allyn, Inc.) – Connex ProBP 3400, Spot Vital Signs 4400, Home BP Monitor

Nihon Kohden Corporation – Life Scope G5, Life Scope SVM Series

Koninklijke Philips N.V. (Philips Healthcare) – IntelliVue MP Series, SureSigns VS Series

Masimo – Rad-97, MightySat Rx with BP Monitoring

Beurer GmbH – BM 26, BM 28, BM 55, BM 85

GE Healthcare – Dinamap ProCare Series, Carescape V100

American Diagnostic Corporation – Diagnostix 700 Series, Prosphyg 775

SunTech Medical, Inc. – Tango M2, CT40, Oscar 2

A&D Medical Inc. – UA-651, UA-767, UA-1030T

Withings – BPM Connect, BPM Core

Briggs Healthcare – HealthSmart Standard, HealthSmart Premium

Kaz Inc. – SmartTemp BP Monitors

Microlife AG – BP A6 BT, BP B3 AFIB, BP W3 Comfort

Rossmax International Ltd. – X5, X9, S150

GF Health Products Inc. – Lumiscope 1143, 1145, 1147

Spacelabs Healthcare Inc. – OnTrak Ambulatory BP Monitor

B. Braun SE – Vista 120, Vista BP Monitoring Systems

Key Market Insights

The rising global prevalence of hypertension is driving demand for BP monitors.

Technological advancements, including AI integration, are enhancing device accuracy and user experience.

The growing trend of home healthcare is increasing the adoption of personal BP monitoring devices.

North America currently dominates the market, with the Asia-Pacific region showing the fastest growth.

Future Market Outlook

The future of the blood pressure monitors market looks promising, with continuous technological innovations leading to more accurate and user-friendly devices. The integration of artificial intelligence and IoT is expected to revolutionize remote monitoring and chronic disease management. As awareness of preventive healthcare grows, the demand for personal monitoring devices is likely to increase, creating significant growth opportunities.

Conclusion

The blood pressure monitors market is on a strong growth trajectory, driven by rising health awareness and technological advancements. Manufacturers focusing on innovation and affordability are well-positioned to capitalize on expanding market opportunities.

Contact Us: Jagney Dave - Vice President of Client Engagement Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Other Related Reports:

Fertility Services Market

Medical Power Supply Market

Post Traumatic Stress Disorder Treatment Market

MRI Guided Neurosurgical Ablation Market

#Blood Pressure Monitors Market#Blood Pressure Monitors Market Share#Blood Pressure Monitors Market Trends#Blood Pressure Monitors Market Size#Blood Pressure Monitors Market Growth

0 notes

Text

Breaking News Business, Economy, Multimedia, Web Development, Science, World

Moved: Online supermarkets saw 9% revenue growth in 2024 CNNBusiness: OpenAI board rejects Elon Musk-led $97 billion purchase offer WPForms: 12 Appointment Reminder Templates for Email and SMS Fotor: Best 10+ Free AI Tools for Teachers EleftherosTypos: Coca-Cola: Consumers of the famous soft drink are clueless - What did it actually contain? NameCheap: Domain redirection tactics to boost SEO rankings WealthyAffiliate: How Chasing Perfection Will Never Work MonsterInsights: How to Uese UTM Parameters in Google Ads (2025) MSN: Disney Plus loses 700,000 subscribers in the first quarter of 2025. [USAID had 700000 subscribers to Disney]

SunnysJournal: Moore vs. Alliant Credit Union Jan 14, 2025. Mortgages are illegal. Fiat currency is inherently fraudulent and illegal. Interest is illegal. The entire fraudulent financial system is illegal. TipRanks: Preparing for a Quantum Computing Nightmare on the Stock Exchange: What Is Q-Day? ABCNews: FEMA halts migrant housing funds in NY after Musk’s criticism [When these audits are done (DOGE), the money found will be in the quadrillions, payback time.] EurAsiaDaily: Musk: The US Treasury pays $ 100 billion annually to unknown persons US Treasury: Treasury Data Pilot Prevents and Recovers $31 Million in Payments to Deceased Individuals During a Five-Month Period In: Briton wants to buy the dump where he lost €700 million in bitcoin

0 notes

Text

Barclays Outlook 2025 – Time to Deliver

Barclays' Outlook 2025 focuses on a year of transition, as global economies navigate the complexities of post-pandemic recovery, geopolitical uncertainties, and accelerating technological disruptions. Key themes include adapting to economic realignment, harnessing opportunities in AI and sustainable investing, and managing risks from geopolitical tensions and inflation. Key Themes and Economic Insights 1. Global Macro Overview - United States: - GDP growth is projected at 2.1% for 2025, supported by fiscal stimulus and rate cuts, but headwinds include waning consumer strength and tariff uncertainties. - Inflation is forecast at 2.3%, with the Federal Reserve likely cutting rates further. - Eurozone: - Growth remains subdued at 0.7%, with recovery led by Spain, while Germany and France face challenges due to sluggish manufacturing and political instability. - The ECB is expected to continue rate cuts, with inflation dropping below 2%. - China: - Growth slows to 4% amid demographic headwinds and a troubled property market. Stimulus measures focus on recapitalizing banks and supporting local governments. - Trade tensions with the U.S. and demographic pressures further complicate the outlook. - United Kingdom: - GDP growth estimated at 1.2%, as inflation recedes. Fiscal pressures and higher unemployment remain concerns, though gilt markets and export-driven equities offer investment opportunities.

2. Equities - Broad Market Trends: - Equity markets have been buoyed by strong performance in AI and mega-cap tech stocks but face valuation challenges. - Sectors such as utilities, consumer staples, and healthcare present defensive opportunities. - Regional Insights: - U.S. equities expected to deliver moderate returns as earnings growth replaces multiple expansion. - European equities offer select opportunities despite overall weaker growth. - Thematic Investing: - AI and automation drive investment narratives, though concerns about sustainability, energy use, and broader economic impact persist.

3. Fixed Income - Yield Dynamics: - Global yields are likely past their peak, with divergence expected as U.S. growth remains robust while Europe and the UK face weaker growth. - Tight credit spreads suggest limited upside, making securitized credit and BB-rated bonds attractive for carry opportunities. - Emerging Market Debt: - Emerging markets present opportunities for diversification, though China’s property market issues pose default risks in Asia. 4. Artificial Intelligence - Productivity vs. Constraints: - While AI adoption accelerates, challenges such as energy demands, training costs, and societal integration slow progress. - Estimates for AI-driven GDP growth range from modest (1.1%) to transformative (100%) over the next decade, depending on scalability and adoption. - Sectoral Impact: - AI’s implementation is uneven across industries, with healthcare and finance requiring stringent oversight due to data sensitivity and accuracy concerns.

5. ESG and Sustainable Investing - Key ESG Factors for 2025: - Environmental: Biodiversity, carbon emissions, and water management take center stage as regulatory and investor focus intensifies. - Social: Human capital development, labor management, and data privacy are critical for sustainable growth. - Governance: Corporate transparency, anti-corruption measures, and board diversity remain vital. - Nature and Biodiversity: - With $700 billion annual funding gaps for biodiversity preservation, companies face financial risks from reliance on ecosystems. Investment Strategies - Equity Markets: - Focus on high-quality, resilient stocks with strong fundamentals and reasonable valuations. - Defensive sectors such as utilities and consumer staples are favored, with selective exposure to value cyclicals. - Fixed Income: - Prioritize securitized credit and short-dated BB-rated bonds for higher carry yields. - Diversify with emerging market debt, emphasizing issuer selection to manage risks. - AI Opportunities: - Invest in task-specific AI applications in areas with clear productivity gains rather than speculative frontier models. - Sustainability: - Align portfolios with ESG principles, emphasizing climate resilience and biodiversity-focused investments. Conclusion Barclays' Outlook 2025 emphasizes a selective, diversified approach to navigate a complex global environment. By balancing pro-growth opportunities with defensive strategies, investors can capture growth while mitigating risks. AI, sustainability, and emerging market dynamics present long-term opportunities for forward-looking portfolios. Read the full article

0 notes

Text

Rock Climber Vs Thomas Inch Dumbbell? #shorts #workout #viral

youtube

It's really annoying this is damned annoying so the retards get people who are strong to lift stuff to show their strong and to go after them they did this to stan today is in his glory and it's going to get worse but really is better and the guy is going to see these people fall and it's not really helping but it seems like it they will try and recover and that's going to be hell this is only 150 lb and the guy looks real muscular and he can't do it like at all now he moved it it lifted a little but really my son can lift that up without too much trouble and when he is bigger probably in a month he can lift up 200 pounds and almost curl it cuz you can curl 150 with one arm and they want to see it but it says you've done it before he says it's true right now it's pretty strong and says but his chest isn't cuz I haven't worked it and it's pulling a muscle because of potassium and these people working it and working it and working it and for some reason this not flushing and he knows why it's the air and it's not helping there's a lot of people are sick from it and it's going to change pretty soon Tommy F will become I'm just scrutiny and it happens and people start going after the ships and that would be Trump and bja and speaking of which right now half of their fleet is heated up and did so in the last 20 minutes and it's about $700 billion and that's half the whole thing almost well it's up to about 2.5 trillion it was a 2.3 trillion this will bring it underneath two trillion and they might start thinking about it but still they're going to keep you assholes we're moving into position they're hitting probably 3% in an hour up to now of ships in my turn to aim and momentarily they will try and break you away and they will be be set

Thor Freya

I have your word I won't be harmed and our son is on the line and says I'm helping if we have assistance and I get that I feel better

Hera

0 notes

Text

Choose the Right Platform to Market Your Business: Facebook vs. Instagram vs. LinkedIn

In today’s digital age, social media platforms have become indispensable tools for businesses to market their products and services effectively. With millions of users worldwide, platforms like Facebook, Instagram, and LinkedIn offer unique opportunities to reach target audiences and engage with potential customers. However, each platform has its own strengths and limitations, making it essential for businesses to understand which one aligns best with their marketing objectives. In this article, we’ll explore the key differences between Facebook, Instagram, and LinkedIn to help you determine the right platform to market your business.

Facebook: The All-Purpose Platform Facebook remains one of the most popular social media platforms globally, boasting over 2.8 billion monthly active users. Its diverse user base spans across different age groups, making it suitable for businesses targeting a wide range of demographics. Facebook offers various marketing tools, including Pages, Groups, and Ads, allowing businesses to create a strong online presence and engage with their audience effectively.

Advantages:

Wide Reach: With billions of users, Facebook provides extensive reach, enabling businesses to connect with potential customers worldwide.

Targeted Advertising: Facebook’s robust advertising platform allows businesses to target specific demographics, interests, and behaviors, ensuring that their ads reach the most relevant audience.

Engagement Features: Features like comments, likes, and shares facilitate interaction with customers, helping businesses build relationships and loyalty.

Limitations:

Declining Organic Reach: Over the years, Facebook’s algorithm changes have resulted in decreased organic reach for business Pages, necessitating investment in paid advertising to achieve significant visibility.

Saturation: With numerous businesses vying for users’ attention, standing out on Facebook requires strategic content and advertising efforts.

Demographic Shifts: While Facebook still appeals to a broad demographic, younger audiences are increasingly gravitating towards other platforms like Instagram and TikTok.

Instagram: Visual Storytelling for Brands

Instagram, owned by Facebook, has rapidly grown into one of the most influential social media platforms, particularly among younger demographics. Focused on visual content, Instagram allows businesses to showcase their products or services through photos and videos, making it ideal for brands with visually appealing offerings.

Advantages:

Visual Appeal: Instagram’s emphasis on high-quality visual content enables businesses to create compelling narratives and showcase their brand identity effectively.

Engagement: The platform’s highly engaged user base actively interacts with content through likes, comments, and shares, fostering community engagement and brand loyalty.

Influencer Marketing: Instagram’s influencer ecosystem provides opportunities for businesses to collaborate with influencers and reach niche audiences authentically.

Limitations:

Limited Linking Options: Unlike Facebook, Instagram has limited options for including clickable links in posts, making it challenging to drive traffic directly to external websites.

Algorithm Changes: Similar to Facebook, Instagram’s algorithm changes can impact organic reach, necessitating a balance between organic content and paid advertising.

Content Saturation: As with any popular platform, competition for visibility is high, requiring businesses to consistently deliver high-quality content to stand out.

LinkedIn: Professional Networking and B2B Marketing

LinkedIn stands out as the premier platform for professional networking, making it an excellent choice for businesses targeting B2B audiences or seeking to establish thought leadership within their industry. With over 700 million users, LinkedIn offers a platform for sharing industry insights, connecting with decision-makers, and generating leads.

Advantages:

Professional Audience: LinkedIn’s user base consists primarily of professionals and businesses, making it an ideal platform for B2B marketing and networking.

Thought Leadership: Publishing long-form content, participating in industry discussions, and sharing insights can help businesses establish themselves as thought leaders in their respective fields.

Lead Generation: LinkedIn’s advanced targeting options enable businesses to reach decision-makers and influencers directly, facilitating lead generation and business development efforts.

Limitations:

Niche Audience: While LinkedIn’s professional focus is advantageous for B2B marketing, businesses targeting consumer audiences may find the platform less effective.

Content Tone: Content on LinkedIn tends to be more formal and professional, requiring businesses to adapt their messaging and tone accordingly.

Limited Organic Reach: Similar to other platforms, organic reach on LinkedIn can be limited, necessitating a combination of organic content and paid advertising to maximize visibility.

Choosing the right social media platform to market your business depends on various factors, including your target audience, marketing objectives, and content strategy. While Facebook, Instagram, and LinkedIn offer unique opportunities for businesses to connect with their audience and promote their brand, it’s essential to evaluate each platform’s strengths and limitations in the context of your specific business goals. By understanding the distinct advantages and challenges of each platform, you can develop a comprehensive social media marketing strategy that effectively engages your target audience and drives business growth.

0 notes

Text

The crypto market is up today and Bitcoin (BTC), Ether (ETH), XRP (XRP), Cardano (ADA) and numerous altcoins rallied to start the month of October. Crypto and equities markets responded positively to the United States’ temporary aversion to a government shutdown, bringing the total crypto market cap up $3.7 billion to $1.1 trillion on Oct. 2.Crypto market 1-day price action. Source: Coin360Let’s examine three of the major factors influencing today’s crypto market rally.Uptober is off to a solid startOctober has historically been celebrated as “Uptober” due to the positive returns in the crypto market. Bitcoin and crypto market prices rallied 5% to over $28,500. The seasonality of Bitcoin’s returns in October has remained positive, only failing to achieve gains 3 times in the month. With such a strong history, this makes October statistically one of the strongest months for Bitcoin price gains.Bitcoin returns by month. Source: Look Into BitcoinA strong October is much needed after the third quarter of 2023 equated to $700 million in losses due to a variety of hacks. Crypto liquidations rule the dayThe crypto market rally started on Oct. 1 and fueled a wave of short position liquidations across the market, totaling over $92 million in 24-hours. Bitcoin short liquidations lead the way with the largest single liquidation of $8.39 million in one transaction on the Huobi exchange. In total, $51.5 million in Bitcoin shorts have been liquidated in 24-hours.Total crypto liquidations in 1-day. Source: CoinglassDespite the short-seller losing streak, 50.5% of the futures market remains short. With the ratio remaining skewed short, a potential opportunity for a short-squeeze could happen and lead to further price upside.Bitcoin short vs. long ratio. Source: CoinglassMacro factors could benefit the crypto market The U.S. government averting a shutdown on Sept. 30, may have helped the initial Oct. 1 crypto price pump which quickly wiped out $70 million in shorts. Despite the Securities and Exchange Commission (SEC) refusing to approve a Bitcoin ETF and their continued war on the crypto market, large institutions remain interested in the space.Such interest has led VanEck and Bitwise to both launch Ethereum ETFs on Oct. 2. The Bitwise ETF will launch on the Chicago Mercantile Exchange (CME) and the VankEck Ether ETF will launch on the Chicago Board Options Exchange (CBOE). While Bitcoin and altcoins still have overhanging risk events that could impact the price, the growing institutional interest is improving sentiment across the market. The Bitcoin Fear & Greed Index highlights the improved sentiment, noting an 11-point increase over the last month. Bitcoin Fear & Greed Index. Source: Alternative.meOverall, crypto markets are likely to continue to experience price volatility. While the positive start to October is providing a nice short-term bump in crypto prices, the market’s reaction to any new enforcement actions or an economic recession will be the true determinant of the direction the market chooses to take. This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

0 notes

Text

'The two movies have fought it out at the box office, but Barbie and Oppenheimer's battle looks set to continue into the 2023 awards season.

Both Barbie and Oppenheimer, or "Barbenheimer" when they join forces, have been the height of entertainment this summer—though the fans of Indiana Jones, Mission: Impossible, and Sound of Freedom would beg to differ.

In reality, it's been no close contest at the worldwide box office, as Greta Gerwig's Barbie has blown away the competition, including Oppenheimer, by raking in over $1 billion. Christopher Nolan's three-hour epic Oppenheimer has performed admirably still, taking in over $560 million, according to Box Office Mojo, powered by IMDb.

Both movies have earned millions at the box office, but which one will have a more successful awards season?

While Barbie is the clear winner financially, who will claim more accolades come awards season? Who is more likely to win the most prestigious honor of Best Picture at the 2024 Academy Awards?

The race for the Oscars this year seems reminiscent of the 2010 Academy Awards, when The Hurt Locker, a gritty war movie that took in less than $50 million, beat the record-breaking 3D adventure Avatar.

Movie producer Laura Pellegrini predicts it to be a tight race between the two blockbusters.

"As people make their predictions and cast their votes, there is no doubt that both films could garner a slew of nominations," the vice president of Rosso Films International told Newsweek. "One competitive category will be Best Director between two very different, yet equally phenomenal filmmakers."

Pellegrini said: "Greta Gerwig created her impressive Barbie-verse from scratch and told a story that was not only entertaining but unexpectedly moving; who would've thought that behind a plastic veneer was a myriad of human emotions? Then there's Christopher Nolan, whose mind-bending direction and towering visual mastery have culminated in what many call his magnum opus with Oppenheimer.

"It will be a tight race, but as it stands, it looks like Nolan could very well garner his first golden statue for Best Director," Pellegrini said.

The betting odds seem to agree with this assertion so far, with Oppenheimer being the favorite to beat out Barbie in almost every category.

What Are the Current Odds for the 2024 Oscars?

Best Picture

Oppenheimer +150 Killers of the Flower Moon +400 Past Lives +800 Maestro +1000 Anatomy of a Fall +1100 Dune: Part Two +1200 Lee +1200 The Color Purple +1400 The Killer +1600 Barbie +1600

In the Best Picture category, Oppenheimer is currently the odds-on favorite to take home the trophy, with Barbie in contention but seemingly unlikely to win. Martin Scorsese's Killers of the Flower Moon, an Apple TV+ movie that will launch in theaters on October 6, is also ranking high in the Oscars race. As many as 10 movies are often nominated for Best Picture which means Barbie could squeak a nomination, but a win is very unlikely.

Best Director

Christopher Nolan (Oppenheimer) +205 Martin Scorsese (Killers of the Flower Moon) +300 Greta Gerwig (Barbie) +450 Bradley Cooper (Maestro) +500 Ben Affleck (Air) +600

While both Nolan and Gerwig are highlighted again in this category, once again Nolan is the strong favorite to take home the gong, which would be his first Academy Award. Martin Scorsese, who has won many before, is also in with a shout.

Best Actor

Cillian Murphy (Oppenheimer) +110 Leonardo DiCaprio (Killers of the Flower Moon) +225 Colman Domingo (Rustin or The Color Purple) +500 Joaquin Phoenix (Napoleon) +650 Alden Ehrenreich (Fair Play) +700

Oppenheimer's leading man, Irish actor Cillian Murphy, is the bookmaker's favorite to win the Best Actor prize at the 2024 Oscars. Ryan Gosling isn't being suggested as a winner for his impressive Barbie performance, though there might be more hype for him in the Best Supporting Actor category. Leonardo DiCaprio could also win his second Best Actor Oscar if his performance in Killers of the Flower Moon impresses voters.

Best Actress

Emily Blunt (Oppenheimer) +215 Fantasia Barrino (The Color Purple) +300 Carey Mulligan (Maestro) +350 Margot Robbie (Barbie) +500 Annette Benning (Nyad) +675

Margot Robbie will surely be included in the conversation for her role as Stereotypical Barbie in Barbie, but Oppenheimer actress Emily Blunt is currently the favorite. Carey Mulligan may also impress in Bradley Cooper's Maestro movie, which doesn't launch until later in 2023.

All of these odds listed are from VegasInsider.com, and the odds vary between betting companies. Generally, the majority have Oppenheimer leading the nominations list with Barbie expected to pick up a couple of nominations but no obvious wins.

The 2024 Academy Award nominations won't be announced until early 2024, with the winners announced during the ceremony, likely in March 2024. We're still a long way off so the current odds are based on what has already been released, and what movies there is currently a buzz around amongst industry insiders. A performance or movie could still emerge and shock everyone between now and then.'

#Oscars#Best Picture#Best Actor#Best Actress#Best Director#Oppenheimer#Barbie#Marot Robbie#Christopher Nolan#Cillian Murphy#Emily Blunt#Mission Impossible#Indiana Jones#Sound of Freedom#Greta Gerwig

0 notes

Text

Our Defense Budget

As I have commented in the past relative to our Department of Defense, their immense responsibility to the security of our country and the American people notwithstanding, they do not have an accounting system, i.e. a set of books, integrated with our national system of accounting that are auditable. In short, their books don't balance.

When Donald Rumsfeld, Secretary of Defense during the administration of George W. Bush (You remember Dubya) entered office, he promised to correct this problem. We soon entered the war in Iraq, and his promise was forgotten.

I think this condition is a disgrace to the people of our country. We have huge transnational corporations in this country (they may be even bigger than our whole government), and their accounts are integrated, they are able to balance their books, and they can account for every dollar they receive and every dollar they spend. There is no reason our government can't do the same except they don't want to.

Solving this problem they won’t be able to lie, cheat, and steal and/or hide what they do from the American people without getting caught. In conjunction with this think the Military Industrial Complex. As long as they can hide the truth, the American people are uninformed and unable to fulfill their Constitutional responsibilities in the electoral process.

Our country has the largest military budget in the whole world and, yet, they want more. As I speak, their requested budget this year is approximately $700 billion, just over three quarter of a trillion dollars, and they still claim they don't have enough money. They want more and they want to take it out of our Social Security and Medicare. If you don't believe me, just listen to Representative Paul Ryan, our illustrious Speaker of the House of Representatives, on the evening news. As usual, we fiddle as Rome burns. This phenomena is what economists term “guns vs. butter”. I submit to you that if a government doesn’t provide for the needs of its people, they may not have a people to defend.

So as not to overburden you with my thoughts, let me refer you to those of others. For your convenience, listed below are a few articles relating to this subject:

Pentagon’s Failure to Audit Contracts Wastes Billions

Pentagon buries evidence of $125 billion in bureaucratic …

https://www.washingtonpost.com/investigations/pentagon-buries-evidence-of-125-billion-in-bureaucratic-waste/2016/12/05/e0668c76-9af6-11e6-a0ed-ab0774c1eaa5_story.html?utm_term=.5a1f121743ed

Audit: Pentagon Cannot Account for $6.5 Trillion Dollars Is Taxpayer Money ttps://www.mintpressnews.com/audit-pentagon-cannot-account-6-5-trillion-dollars-taxpayer-money/219246/ Fake News? I don’t think so. There is much more. It’s easy to Google. Study for yourself and see what a sick state our nation is in; and, you know? There’s absolutely no sense in it.

Steven P. Miller @ParkermillerQ, CEO and Founder of Gatekeeper-Watchman International Groups Sunday, April 23, 2023 Jacksonville, Florida., Duval County, USA. Instagram: steven_parker_miller_1956, Twitter: @GatekeeperWatchman1, @ParkermillerQ, https://twitter.com/StevenPMiller6 Tumblr: https://www.tumblr.com/blog/gatekeeperwatchman, https://www.tumblr.com/gatekeeper-watchman Facebook: https://www.facebook.com/StevenParkerMillerQ #GWIG, #GWIN, #GWINGO, #Ephraim1, #IAM, #Sparkermiller,#Eldermiller1981

0 notes

Text

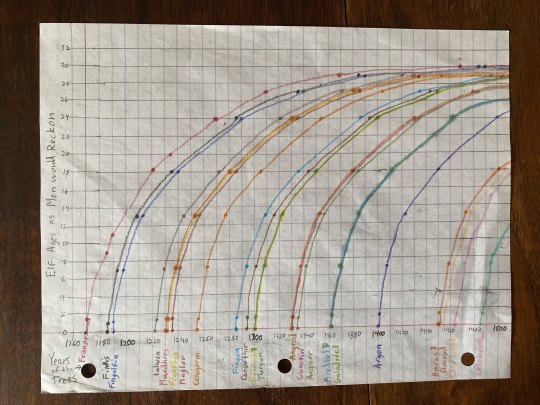

Tanoraqui’s Coherent Theory of Finwëan Relative Ages (Years of the Trees Only)

Click Here to see the complete timeline of birth years and other notable events, including reasoning for various non-canon dates, and be sure to visit the second tab for a breakdown of Elf vs. Man aging rates and foundational headcanons about how time works and a few key familial relationships! Also below the cut.

Note on graph: ”as Men would Reckon” meaning, if you looked at that elf’s face and watched them behave for a bit, how old would you say they are if they were a human.

MORE CHARTS!:

Time Headcanon:

Tolkien's calculation of roughly 10 Sun Years to 1 Tree Year is correct, but time passes more slowly [closer to the Trees/in Valinor in general/close to the Valar themselves] [take your pick], or at least it seems to; same difference because time is fake, especially for immortals. This is called "Valinorian Temporal Reduction" (VTR) and it shakes out to about 1/5 the speed of Sun Years, or 1 Tree Year in Valinor = 2 Sun Years. NB: this did NOT effect Elves left in Middle Earth, which is why the Moriquendi population has swelled greatly in proportion to the Calaquendi by the time the Noldor Exiles arrive.

Aging Headcanon:

Somewhere around looking 30-35ish, Elves really hit that "ageless beauty" where they look young and ancient at once, and stay there. Some get there faster, or seem to age into 40s or even 50s, due to greater stress in life (common in those who stay longer in Middle Earth) This may or may not alleviate with rest; Elves, too, can be "old souls." Presenting as older is also common in elves with children, grandchildren, etc (due to personal sense of maturity/responsibility).

In fact, in Middle Earth, certainly in First Age Middle Earth, a 600-year-old Elf probably looks and acts/feels solidly 35, if not 40, though it's still plateauing there. The increased aging rate is almost entirely from age 100 onward - childhood aging (to mortal "18") is still about the same no matter what stressors are about. That is, emotional maturity can be affected, but the hröa's aging isn't any more than a Man's would be.

Note that by all this logic of year counts and aging, Finwë - who I think wasn't one of the original 144 Elves but was probably the quickly coming 2nd or 3rd gen - was about 800-860 (sun) years old (700-800 ME years + 72 VTR), putting him in Mannish mid to late 30s at Fëanor's birth. He probably picked up the equivalent of a year or two from then until his death.

Key Finwëan Familial Headcanons the Shaped the Birth Years Headcanons (no particular order):

Finarfin and Earwen also married young, even younger than Fëanor and Nerdanel (ELOPED, in fact)

Fëanor and Nerdanel have kids whenever they get particularly horny over creation, with no regard for anything or anyone else

Maedhros is slightly older than Finarfin, but this is the only Finwean grandchild/child mix

No children were conceived out of competition or spite, except maybe great-grandchildren

Orodreth is a great-grandchild, son of Angrod and Eldalote

Orodreth was a mature enough adult in FA 102 that leaving him in charge of Tol Sirion was reasonable

It's traditional in Middle Earth to have elf kids at the same time as other elf kids. Slightly less common in Valinor, but still common.

Apprenticeship standardly starts at E!15-16, Curufinwës all started at E!14. (I know in my heart that the Noldor have guilds, though I don't think "journeyman" is what they'd call that rank - journeying prob. wouldn't have been as much of a thing?)

Again, check out the full timeline here! Yes, it was significantly faster (and more fun) to make a chart myself with colored pencils than to enter a billion values into Excel, especially given that there’s no actual formula for this Man/Elf age conversion. I think it got lost with everyone mixed together, but Fëanorians are in red shades, Fingolfinians in blues, and Finarfinians in yellows (more or less).

#the silmarillion#hm maybe i'll just tag the hot ticket characters? nah i'd feel bad#house of finwe#noldor#this fandom#my fic#math

70 notes

·

View notes

Photo

Tesla Stock May Gain Momentum After $1.5 Billion Bitcoin Purchase: Analyst

Bitcoin surged Monday as Tesla (TSLA) announced it would buy $1.5 billion of the cryptocurrency after founder Elon Musk has voiced his support of the cryptocurrency in recent weeks. Tesla stock rose.

X

The luxury electric car company said it will also accept Bitcoin as a form of payment in the near future, according to the Securities and Exchange Commission filing.

Wedbush analyst Dan Ives said the Bitcoin purchase, which will serve as an alternative reserve asset, “could put more momentum into shares of Tesla as more investors start to value the company’s bitcoin/crypto exposure as part of the overall valuation.”

The announcement comes as Musk has been tweeting about bitcoin and Dogecoin, a joke currency making fun of bitcoin and others.

Musk added the hashtag bitcoin to his Twitter profile, then said last week that Bitcoin was “on the verge of getting broad acceptance” .

“I do at this point think bitcoin is a good thing, and I am a supporter of bitcoin,” Musk said during a Clubhouse chat.

In December, Michael Saylor, the founder of MicroStrategy (MSTR), which went on its own bitcoin buying spree last year, suggested Musk convert Tesla’s balance sheet to bitcoin from dollars. Musk asked if large transactions were possible.

IBD Live: A New Tool For Daily Stock Market Analysis

Bitcoin Price, Tesla Stock

After falling back down to $30,000 in recent weeks, Bitcoin prices hit a new high of $44,900 following the news before giving up some gains. But by 4 p.m. ET, Bitcoin traded near $42,000, vs. about $39,000 before the Tesla news.

Among Bitcoin stocks, Grayscale Bitcoin Trust (GBTC), which tracks Bitcoin price movements, surged 21%. PayPal (PAYL) added 4.7% and Square (SQ) rallied 8.15%. Marathon Patent Group (MARA) soared 42% and Riot Blockchain (RIOT) shot up 40%.

Tesla stock, which had already soared more than 700% last year, rose 1.3% to 863.42 on the stock market today.

In October, PayPal launched a service that lets customers to buy, hold and sell Bitcoin from their PayPal account. It also is making it available as a funding source for purchases at its merchants worldwide.

Also in October, Square announced the purchase of $50 million in Bitcoin, saying it has the potential to become more ubiquitous in the future. The move came after its Cash App began allowing Bitcoin trades in 2018.

Other companies have joined the cryptocurrency trend recently, bringing it to mainstream investors.

Massachusetts Mutual Life Insurance purchased $100 million in Bitcoin for its general investment fund. Visa (V) will offer a credit card that lets users earn money back in the form of Bitcoin.

Follow Gillian Rich on Twitter for investing news and more

YOU MAY ALSO LIKE:

Bitcoin, Blockchain And Cryptocurrency News

Is Tesla Stock A Buy After A Giant Run And Transformative, Robust Year?

624 notes

·

View notes

Text

How Investing in Cryptocurrencies Holds Up Against Traditional Investments

The cryptocurrency market is growing rapidly, with the largest cryptos in particular having spent much of the summer and fall rallying. According to an article on CoinDesk, the crypto market cap has surged to a record $2.7 trillion, tripling the $770 billion cap from the beginning of the year. Bitcoin (BTC) recently reached a fresh all-time high of $66,000, while Ethereum (ETH) climbed to a five-month high of more than $4,200.

All of this is leading corporations of all kinds to invest in cryptocurrencies on the simple grounds that the cryptos have outperformed traditional assets and varying indices. In our article ‘The Ultimate Beginner’s Guide to Investing and Trading Bitcoin and Cryptocurrencies’, we discussed how investing in cryptocurrency can lead to significant gains.

CRYPTO VS. STOCKS

Both cryptocurrencies and stocks have good and bad days. For instance, as of the writing the European stock market is facing weak trading over Asia-Pacific jitters. The pan-European Stoxx 700 recently closed just below the flatline due to concerns over the Chinese property sector. These are specific examples that have affected markets of late. But more generally, market volatility, government regulations, and other sources of uncertainty can regularly lead to losses for even the most experienced and careful investors. That said, stocks also come with a long history that makes it easier for investors to recognize trends and predict future movements. Stock markets are also well regulated and widely traded, which further sets them apart from decentralized cryptocurrency assets. However, the crypto market is catching up as its capitalization increases and also regulation will be put in place. The proposed MiCA (Markets in Crypto Assets) framework of the EU is a recent example.

CRYPTO VS. BONDS

A bond is a loan from an individual to a company or a government. When an investor buys a bond, the entity that sold the bond is in debt to that person. For a certain period of time, the investor will get interest (like say 3% p.a.) on the amount lent out, and eventually he or she will receive the entire amount in return. The only major risk with bonds is that an investor won’t receive any interest payments (or even the principal amount) if the borrower goes bankrupt or defaults for any other reason. Additionally, bonds can fail to generate returns that keep pace with inflation. The value of issued bonds often erodes when inflation rises. By contrast, cryptocurrencies are untethered to wider economic disruptions, and cannot be affected by any entity’s failure to maintain a deal – except that hackers might steal crypto left on an exchange. But in fact, crypto tends to profit from rising inflation as it is regarded a hedge against inflation. And moving your crypto to your own wallet will keep you safe.

CRYPTO VS. FOREX

Foreign exchange of global currencies (or forex) offers unmatched liquidity compared to crypto, or any other market for that matter. But value in this particular market stems from the economic conditions and fluctuations of the countries behind the currencies. This is why investors pay close attention to the changes in major currency pairs during times of high volatility. The trade volatility charts on FXCM depict what this sort of tracking looks like. They essentially depict bid and ask prices for major pairs such as the EUR/USD and USD/GBP, but do so in such a way as to highlight the pairs exhibiting the most movement. While this is a helpful way to visualize and trade forex though, the need for volatility tracking highlights a key difference between forex and cryptocurrency in and of itself. Forex traders need to seek out volatility if they’re to find much short-term potential for gains; crypto markets are extraordinarily volatile nearly all the time. That makes them less stable, but also means it’s easier for investors to spot potential opportunities for swift earnings.

CRYPTO VS. GOLD

Based on a recent gold market report from Reuters, gold prices have extended gains of late due to a softer dollar. With U.S. treasury yields pushing higher over inflation concerns, gold trading has remained in a range between $1,720 and $1,820 — making it a stable, liquid investment choice. These kinds of conditions are behind the “safe-haven asset” label that is often applied to gold. Some have begun to assign this label to cryptocurrencies as well, largely on the grounds that it they provide a “haven” during times of spurring inflation like we have been observing in fall 2021. Generally speaking though, crypto is far more volatile. The other key difference, meanwhile, is that gold is subject to import taxes and is far less portable. Investors need to spend more money protecting stashes of physical gold (even if only indirectly) than securing crypto wallets.

CONCLUSION

Overall, investing in crypto depends on your risk tolerance and portfolio objectives. If you want to diversify away from traditional investments, digital money is a good choice because it isn’t tied to a specific fiat currency, country, or financial market. That said, like any investable asset, cryptos still come with risks that need to be managed carefully. Timing the crypto market’s major ups and downs is key. This is where Crypto Captain can help you.

For More Information: https://heliolending.com/

#crypto loan#criptocurrency loan#nexo crypto loans#bitcoin loans#bitcoin loan#crypto loans uk#lending crypto

3 notes

·

View notes